The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

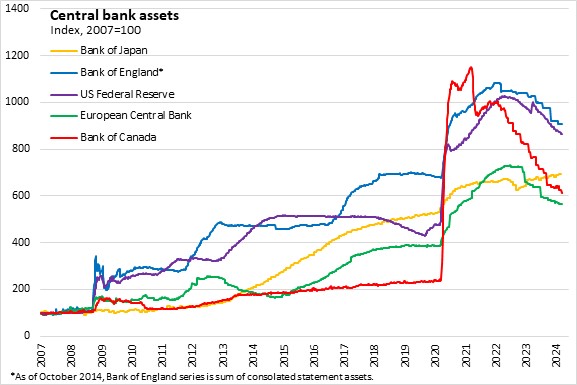

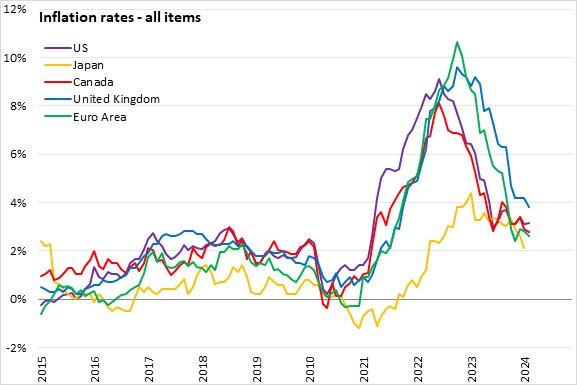

March 20, 2024US MONETARY POLICY At its scheduled Federal Open Market Committee (FOMC) meeting, the Federal Reserve announced that it will maintain the target range for the federal funds rate 5.25% to 5.50%. Reductions in the target range were not considered appropriate at this time as the Committee has yet to see sustained movements towards the 2% inflation target. The Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve's Balance Sheet that were issued in May 2022. As one of the policy decisions the Federal Reserve will direct Open Market Desk until directed otherwise.

Recent economic indicators show that US economy has been expanding at a steady pace. Over the past year, inflation has eased, but remains elevated above the 2% target rate. The United States Consumer Price Index (not seasonally adjusted) for All Urban Consumers increased 3.2% year-over-year in February 2024. Job gains have remained strong with unemployment remaining low. The US unemployment rate was up 0.2 percentage points to 3.9% in February 2024 while the participation rate remained unchanged at 62.5%. The US employment ratio decreased 0.1 percentage points to 60.1% in February 2024. US real GDP growth was 3.2% (seasonally adjusted annualized rate) in Q4 2023, the sixth consecutive quarter of growth at an annualized pace of 2.0% or higher.

The Committee will continue to monitor economic developments and is prepared to adjust the monetary policy measures as appropriate, taking into account information on labor market conditions, inflation pressures and inflation expectations, and financial and international developments. The next scheduled FOMC meeting will be held on April 30 - May 1, 2024.

Source: US Federal Reserve, FOMC Statement

<--- Return to Archive