The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

March 07, 2024EUROPEAN CENTRAL BANK MONETARY POLICY The European Central Bank (ECB) announced today that it would keep the three key ECB interest rates unchanged. The interest rates on the main refinancing operations, the marginal lending facility and the deposit facility will remain at 4.50%, 4.75% and 4.0% respectively.

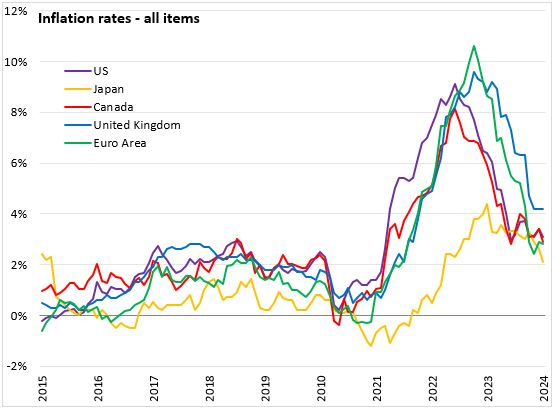

Inflation has continued to slow, edging down to 2.8% in January. Food price inflation fell again to 5.6% while energy prices declined for the second consecutive month. Goods price inflation also fell further and services price inflation finally began to edge lower. Measures of underlying inflation declined further as the impact of past shocks continue to fade and tight monetary policy weighed on demand. Inflation is expected to continue on this downward trend in the coming months. ECB projections of inflation are 2.3% in 2024 followed by 2.0% in 2025.

Economic activity remains weak in the Euro area as consumer spending, investment and exports remain weak. The unemployment rate remains at record lows and employment growth is outpacing growth in output. Going forward, growth is expected to be supported by a rebound in real incomes, reflecting wage growth and slowing inflation. As the impact of past interest rate increases fades, demand for euro area exports is expected to increase. ECB projections of real GDP growth have been revised down to 0.6% in 2024 and 1.5% in 2025.

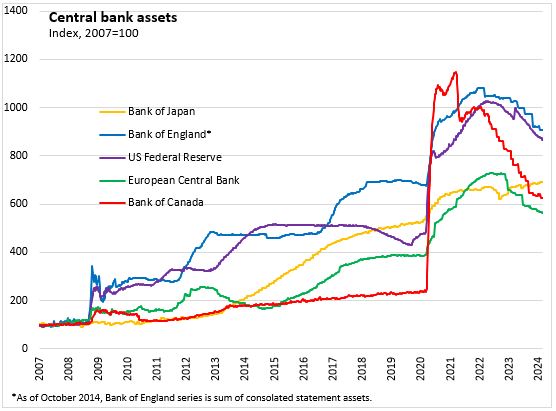

The asset purchase programme (APP) portfolio is declining at a measured and predictable pace, as the Eurosystem does not reinvest all principal payments from maturing securities. The Governing Council intends to reinvest the principal payments from maturing securities purchased under the pandemic emergency purchase programme (PEPP) during the first half of 2024. Over the second half of the year, it intends to reduce the PEPP portfolio by €7.5 billion per month on average. The Governing Council intends to discontinue reinvestments under the PEPP at the end of 2024.

The Governing Council notes that future policy rate decisions will be based on its assessment of the inflation outlook (including the dynamics of underlying inflation), incoming economic and financial data, and the strength of monetary policy transmission.

The next scheduled monetary policy meeting will be on April 11, 2024.

Source: European Central Bank: Monetary Policy Decisions, Monetary Policy Statement (Press Conference)

<--- Return to Archive