The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

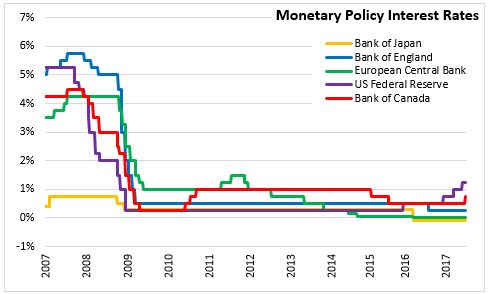

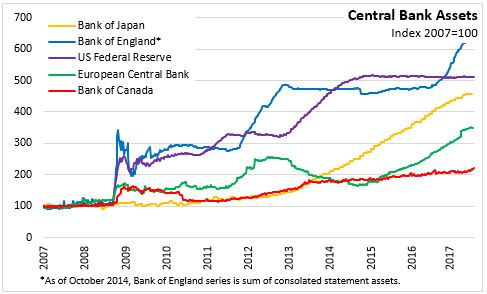

July 20, 2017MONETARY POLICY: EUROPE At today’s meeting, the Governing Council of the European Central Bank(ECB) announced that the key ECB interest rates are unchanged, and that they are expected to remain at the current level for an extended period of time, well past the horizon of net asset purchases. Monthly asset purchases will run at the current pace of €60 billion per month until December 2017 or beyond, until the path of inflation is consistent with the Governing Council's inflation aim. The Governing Council is prepared to increase the programme in terms of size and/or duration if the outlook becomes less favourable or if financial conditions deteriorate.

Euro area real GDP grew 0.6 per cent in Q1 after growth of 0.5 per cent in Q4 2016. Recent data point to a continuation of broad based growth. Monetary policy measures are supporting domestic demand and facilitating the deleveraging process. Investment continues to benefit from favourable financing conditions and improvements in corporate profits. Past labour market reforms are supporting employment gains. A global recovery has supported trade. The ECB notes that growth is being dampened by the slow pace of structural reforms in product markets and remaining balance sheet adjustment.

Annual inflation was 1.3 per cent in June, down from 1.4 per cent the previous month as energy inflation was down. Inflation is likely to remain around current levels in the short-term. Underlying inflation pressures remains low and have yet to pick up as wage growth is subdued.

Sources:

European Central Bank

<--- Return to Archive