The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

July 12, 2017BANK OF CANADA MONETARY POLICY The Bank of Canada is raising its target for the overnight rate to 3/4 per cent. The Bank Rate is correspondingly 1 per cent and the deposit rate is 1/2 per cent. Recent data have bolstered the Bank’s confidence in its outlook for above-potential growth and the absorption of excess capacity in the economy.

Global Growth

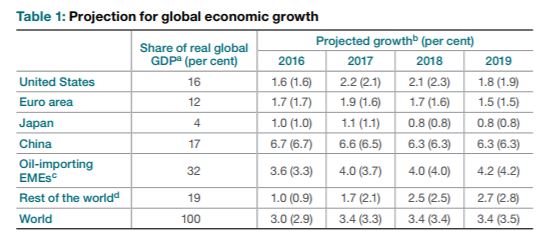

Global economic growth continues to strengthen and broaden across countries and regions. The US economy is expanding at a moderate pace, and there are signs of a more consistent pickup in activity across the euro area. Growth has resumed in some emerging-market economies (EMEs) that had been in recession.

Chart Source: Bank of Canada

A number of unknowns, particularly with respect to US trade policy, still cloud the outlook. While the global projection continues to incorporate the judgment that such uncertainty will have a negative impact on trade and investment decisions, these unknowns remain a downside risk to the projection.

Yields on long-term sovereign bonds have edged up since April, but they remain low by historical standards. The increase in yields has been driven by stronger growth and market expectations of less accommodative monetary policy in advanced economies, including the reduction of the Federal Reserve balance sheet that is anticipated to begin later this year. Global credit spreads remain near their post-crisis lows, and equity prices are close to past highs. The US dollar has seen a modest depreciation.

Recent developments point to more momentum in the euro area than anticipated in April, and growth has become more widespread across member countries. In the first quarter, every member experienced positive growth, which was the second time this happened in the past year.

In Japan, sluggish wage gains and slow potential growth suggest a pace of expansion of around 1 per cent over the projection horizon.

US Growth Outlook

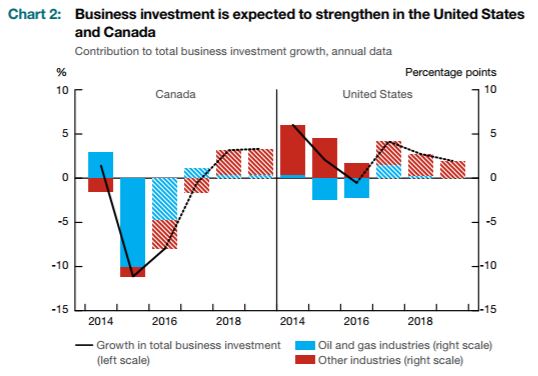

Economic developments in the United States have evolved largely as expected at the time of the April Monetary Policy Report. First-quarter growth slowed primarily because of transitory factors, including drag from inventories and a weather-related decline in the consumption of utilities. Meanwhile, growth was supported by an unexpectedly strong and broad increase in business investment, including a sharp rebound in energy investment.

Recent data, including labour income and consumption, are in line with an expected rebound in growth in the second quarter. Inflation has been weaker than expected, owing in large part to temporary factors. The pace of job gains remains consistent with a falling unemployment rate. The prospects of expansionary US fiscal policy are less clear than they appeared in April, given delays in decision-making processes. Consequently, the fiscal stimulus assumed in the January and April forecasts has been removed.

Chart Source: Bank of Canada

Canada Growth Outlook

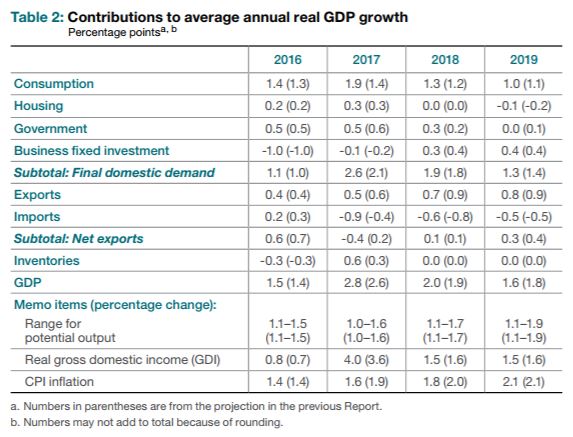

The Bank of Canada expects Canada's GDP to grow by 2.8 per cent in 2017 (up from 2.6 per cent in April), 2.0 per cent in 2018 (upfrom 1.9 per cent in April) and 1.6 per cent in 2019 (down from 1.8 per cent in April).

The output gap is expected to close around the end of 2017, earlier than projected in April.

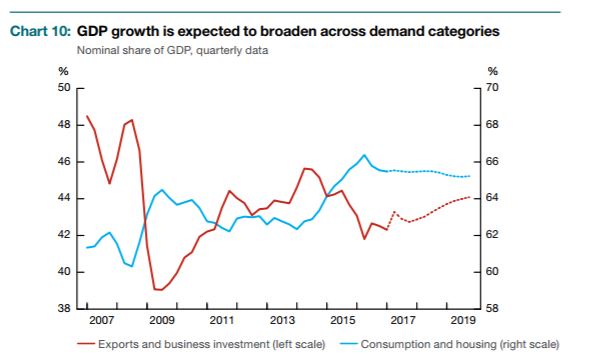

Over the projection horizon, the Bank expects the economy to continue to absorb excess capacity by expanding faster than potential output, albeit at a slower pace than in recent quarters. Economic activity will be supported by rising foreign demand, fiscal stimulus and accommodative monetary and financial conditions. Increased exports and investment will contribute to the anticipated broadening in the composition of demand, helping to sustain economic expansion as growth in both residential investment and household consumption slows.

Chart Source: Bank of Canada

Inflation Outlook

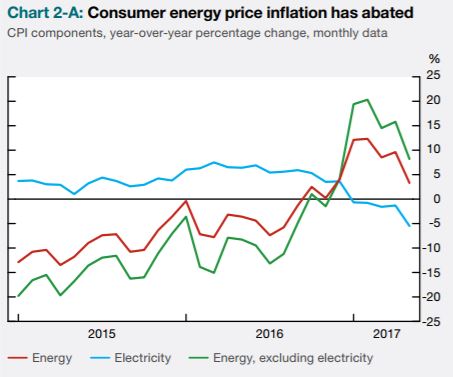

Consumer price index (CPI) inflation has been soft recently, for the most part as a result of food, electricity and automobile prices. Excess supply in the economy has also been a factor. Inflation is forecast to pick up and return close to 2 per cent in the middle of 2018 as relative price movements dissipate and excess capacity is absorbed.

Chart Source: Bank of Canada

CPI inflation has fallen since the beginning of the year, reaching an estimated 1.4 per cent on average in the second quarter, while two of the Bank’s three measures of core inflation have also continued to declined. The slowdown in inflation can be explained mainly by easing consumer energy and automobile price inflation. Both slower gasoline price inflation and the electricity rebates from the Ontario government have weighed on consumer energy prices.

Chart Source: Bank of Canada

The expected closing of the output gap will have an impact. In the third quarter of this year, the effect of excess supply subtracts 0.2 percentage points from inflation. As excess supply is absorbed, inflation is expected to return sustainably close to the 2 per cent target.

The next scheduled date for announcing the overnight rate target is September 6, 2017. The next full update of the Bank’s outlook for the economy and inflation, including risks to the projection, will be published in the MPR on October 25, 2017.

Bank of Canada Press Release, Monetary Policy Report.

<--- Return to Archive