The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

June 14, 2017NATIONAL BALANCE SHEET ACCOUNTS, Q1 2017

In the first quarter of 2017, Canadian national net worth rose 2.6 per cent to $10.5 trillion. The gains were due to increases in both national wealth (value of non-financial assets) due to rising values of residential real estate and natural resources along with an increase in net international investments. International assets have exceeded international liabilities for 10 consecutive quarters. On a per capita basis, national net worth increased to $287,000 at the end of the quarter.

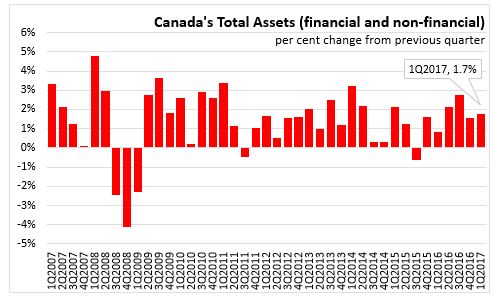

Total assets, including financial and non-financial assets increased by 1.7 percent to $35.4 trillion at the end of first quarter 2016. Total financial assets increased by 1.7 per cent.

Household sector

In the first quarter 2017, Canada’s household sector net worth at market value rose 2.2 percent to $10.5 trillion total, or $287,700 per capita. The increase in net worth was mainly attributable to a 2.3 per cent gain in the value of financial assets, as the value of equity and investment funds shares benefited from stronger domestic and foreign equity markets. Households' non-financial assets grew 1.7 per cent, mainly due to real estate assets.

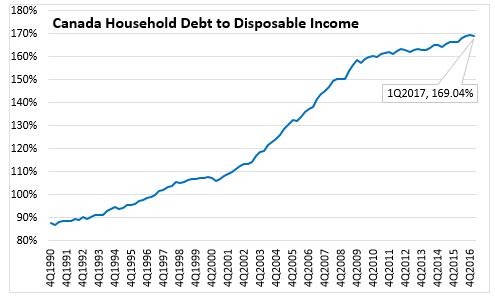

Households total debt to disposable income ratio declined to 169.04 per cent in the first quarter 2017, compared to 169.39 per cent in the previous quarter, as household credit market debt growth was slower than growth in disposable income.

Government sector

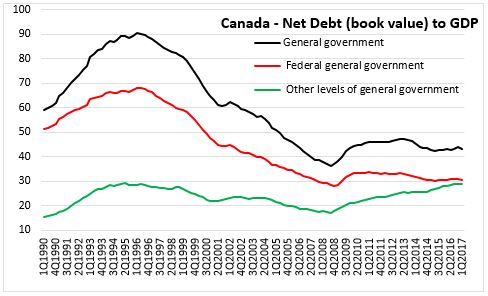

At the end of the first quarter 2017, general government net debt (book value) stood at 43.27 percent of GDP, down from 43.88 per cent in the previous quarter. The federal government's net debt to GDP ratio fell from 30.78 to 30.71 per cent, while other levels of government saw an increase in net debt to GDP to 28.91 per cent, up from 28.89 per cent in the previous quarter.

Corporate sector

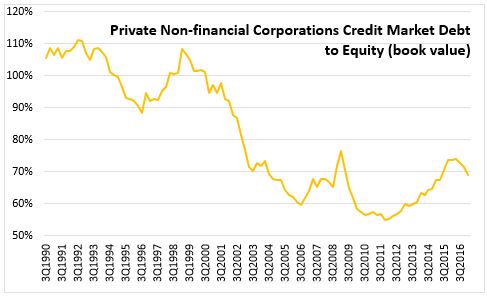

The credit market debt to equity ratio of non-financial private corporations was 68.83 cents of credit market debt for every dollar of equity in the first quarter 2017, down from 71.53 cents in the previous quarter. There was greater demand for marketable funds in the quarter reflecting stronger mergers and acquisition activity and higher capital investment financing requirements.

Statistics Canada: National Balance Sheet and financial flow accounts

<--- Return to Archive