The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

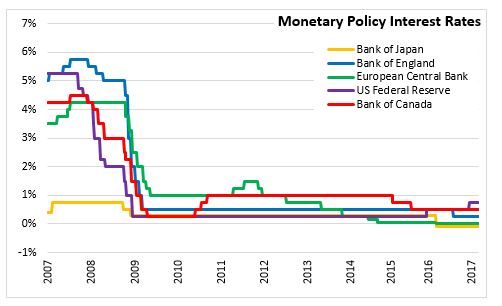

March 01, 2017BANK OF CANADA MONETARY POLICY The Bank of Canada maintained its target for the overnight rate at 0.5 percent with the Bank Rate continuing at 0.75 per cent and the deposit rate at 0.25 per cent.

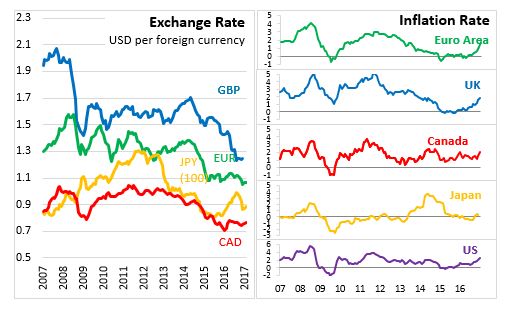

The Bank of Canada noted that the recent data on global economies has been consistent with their latest projections of improving growth. The Canadian data is also on track with indicators of consumption and housing suggesting a strong Q4. Exports continue to face ongoing competitiveness challenges. The Canadian dollar and bond yields are little changed since January. Persistent slack in Canadian economy continues to be reflected in subdued wage growth and hours worked even as employment levels have risen.

CPI inflation was up to 2.1 per cent in January, reflecting higher energy prices due in part to carbon pricing measures being introduced in two provinces. The Bank is looking through these temporary factors to judge inflation pressures with the Bank's three measures of core inflation continuing to point to material excess capacity.

The next Monetary Policy Report with an updated outlook for the economy and inflation will be April 12, 2017.

Bank of Canada

<--- Return to Archive