The Economics and Statistics Division maintains archives of previous publications for accountability purposes, but makes no updates to keep these documents current with the latest data revisions from Statistics Canada. As a result, information in older documents may not be accurate. Please exercise caution when referring to older documents. For the latest information and historical data, please contact the individual listed to the right.

<--- Return to Archive

For additional information relating to this article, please contact:

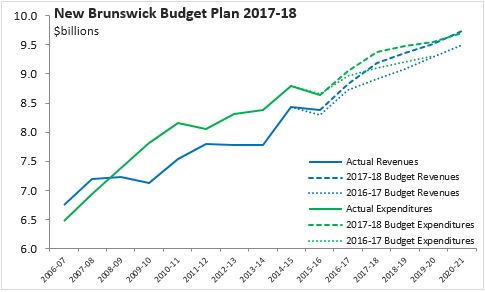

February 08, 2017NEW BRUNSWICK BUDGET 2017-18 As it was last year, New Brunswick is the first province to table its budget for the 2017-18 fiscal year. New Brunswick's deficit is estimated to be $192 million in 2017-18. Over the subsequent two fiscal years, the New Brunswick government's deficit is expected to narrow before reaching a suplus of $21 million in the 2020-21 fiscal year. New Brunswick has eliminated the contingency reserve it used in the last fiscal plan.

From 2016-17 through 2020-21, New Brunswick's revenues are expected to grow at an annual average pace of 2.5 per cent while expenditures are projected to grow by 1.7 per cent. Compared with last year's fiscal plan, New Brunswick is now expecting faster growth in both revenues and expenditures in 2017-18. This is largely due to higher federal revenues and associated expenditures for infrastructure, prior years' adjustments to revenues and consolidation of nursing homes into provincial financial statements.

New Brunswick's fiscal plan represents a very stable footprint of government in the provincial economy. New Brunswick's revenues account for just under 27 per cent of GDP. Expenditures are expected to decline from 27.4 per cent of GDP in 2017-18 to 26.8 per cent of GDP in 2020-21. The deficits projected for 2017-18 through 2019-20 amount to less than 0.6 per cent of GDP at their largest.

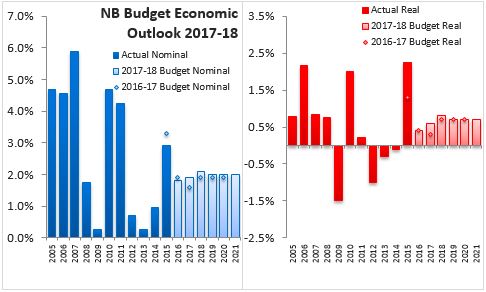

Despite unexpected strong growth in real GDP in 2015, New Brunswick's economic outlook for 2017-2021 has not been revised significantly since last year . New Brunswick's real GDP growth is expected to by 0.6 per cent in 2017, with growth rising to 0.8 per cent in 2018 and stabilizing at 0.7 per cent thereafter. The mining sector in New Brunswick is recovering from the closure of the Picadilly potash mine while the forestry sector expected to take advantage of rising US growth. Public investment projects are expected to lift the pace of growth in 2017 and 2018 and employment is expected to rise after declining for 7 of the last 8 years. As in other Atlantic provinces, New Brunswick's economic and employment outlook faces demographic headwinds as older workers retire in increasing numbers.

Key Measures and Initiatives

After significant program and tax changes in the 2016-17 Budget, the latest New Brunswick's fiscal plan focuses on getting back to balance at a measured pace that maintains social programs. There were few new initiatives and tax changes in the 2017-18 Budget:

- Raising the Small Business Investor Tax Credit from 30 per cent to 50 per cent

- Continuing to lower the small business Income Tax rate from 3.5 per cent to 3.0 per cent (effective April 1) with further reductions to 2.5 per cent at a later date

- Increasing funding for Education and Early Childhood Development (4.9 per cent) as well as Post-Secondary Education (5.4 per cent)

- Doubling the daycare assistance program budget by January 1, 2018

- Additional funding for preschool autism interventions

- Doubling funding for the Equal Employment Opportunity Program

New Brunswick Budget 2017-18

<--- Return to Archive